Yes, mobility is priceless. But does the price of a prosthetic leg really have to be so high?

By Larry Borowsky

Last fall, a prosthetics industry innovator named Alan Hutchison rekindled an old debate by posing this question on LinkedIn: “Why should you pay more for a prosthetic with a microprocessor knee than for a new average family sedan car? What’s the logic of this, given that the technologies in the feet and knees are similar to those for leaf springs and power liftgates [that represent] a fraction of a car’s total cost?”

To put hard numbers to this: The average new family sedan (e.g., a Chevy Malibu) retails for about $30,000. The average prosthetic leg equipped with a microprocessor knee (e.g., an Ottobock C-Leg) will cost you and/or your insurer about twice that amount.

“How can the reimbursement systems justify paying so much?” asked Hutchison, cofounder and CEO of the distributed-care startup ProsFit. If the per-unit cost were lower, couldn’t you sell far more devices, improve far more amputees’ lives, and generate equal or greater profits?

The comments section erupted. Car prices are less outrageous because demand is so much greater, went one popular argument; if prosthesis ownership was as universal as car ownership, prices would fall. A second argument: Cars are mere conveniences, whereas limbs equipped with microprocessor knees (MPKs) are life-changing amenities and therefore infinitely more valuable. Several people observed that the price tag for a prosthesis covers not only the hardware but also several years’ worth of the clinician’s limb-care expertise. “If prosthetists were paid for their clinical care and not for devices delivered, the cost would come down,” noted one commenter. Another added: “A car dealer sells inventory, produced at scale and force-fed to the market. The prosthetist provides custom solutions to meet a very specific set of functional and clinical needs.”

Of course, no comment thread is complete without some bitter snark. “For-profit healthcare system does exactly what it has been designed to do: making profit,” one cynic jeered. Another chimed in: “It’s a racket between the old boys from MBA schools making side deals in the back room.”

The snark seems to capture the emotional truth of most amputees. Unlike the car marketplace, the prosthesis marketplace isn’t one that most people enter by choice. And in the car market, buyers negotiate directly with sellers and can opt out at any point, giving them real bargaining power. In the prosthetics market, there’s little negotiation to speak of—at least, little that involves the consumer.

Instead, the bargaining takes place among device manufacturers, insurance companies, government agencies, and healthcare conglomerates. And for better or worse, the starting point for those discussions is the L-Code system.

IF YOU’RE NOT FAMILIAR WITH L-CODES, they’re part of Medicare’s Healthcare Common Procedure Coding System (HCPCS), which providers and payers use to identify every procedure and device. The HCPCS is the common language of healthcare finance, and it’s spoken by everyone who participates in the marketplace. Except patients.

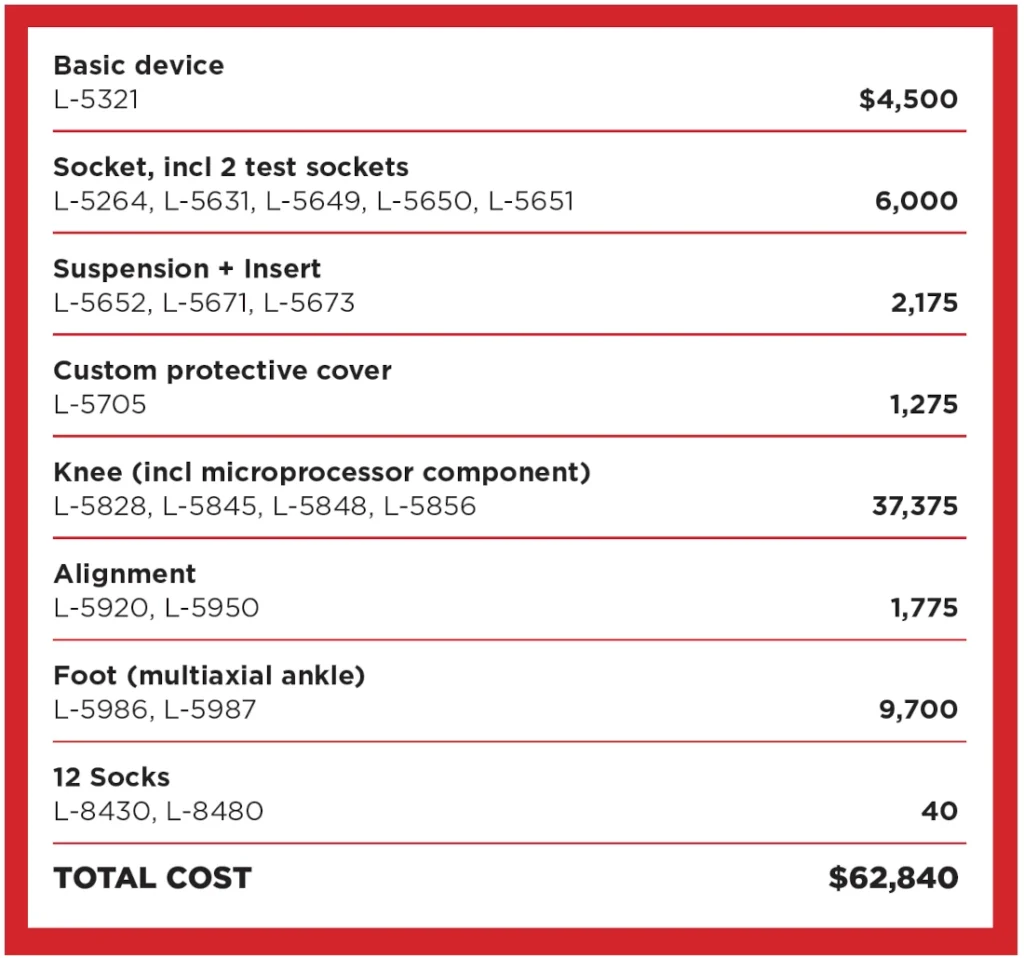

HCPCS codes for orthotic and prosthetic devices are designated by the prefix “L.” Each component of your prosthesis, from the $30,000 bionic knee (L-5856) to the $3 one-ply sock (L-8480), has its own L-Code or combination of codes. A single leg typically consists of 15 to 20 distinct L-Codes, and each code carries a standardized reimbursement rate that’s established by Medicare. The rates vary by state, and they aren’t binding on private insurers or other payers (such as the VA or worker’s comp agencies), who can negotiate their own rates.

When your prosthetist assembles your leg, the clinic also assembles a list of L-Codes and their corresponding payments. Add them all up, and that’s what your device costs. A claim for that amount gets sent to your insurer; a check for that amount gets sent to the clinic. Here’s a simplified example for an above-knee prosthetic leg delivered to a Medicare patient:

It seems like a pretty thorough accounting on the surface. But, like every other healthcare invoice, this one reveals nothing about the underlying costs upon which the prices are based. What percentage of that $62,840 covers the manufacturer’s up-front investment in research, product development, materials, labor, manufacturing, shipping, and other costs of producing the device and bringing it to market? How much gets siphoned off by the insurer and the health-plan administrator? What portion do corporate shareholders add to their investment portfolios? What’s left over for the prosthetic clinic?

Dale Berry, a seasoned prosthetist and longtime Hanger executive who now operates Prosthetic Xpert Consultation, gave Amplitude some realistic estimates. These numbers are reasonable but inexact; they pack a tremendous amount of real-world variation into a single number. But they’re close enough to illustrate some of the broad market forces that drive prices.

“The C-Leg is the number-one selling knee in the world, and it’s got an established price as set through Medicare and the insurance companies,” says Berry. “As a prosthetist, I buy the knee—just the knee, not the whole prosthesis—for around $20,000, and Medicare reimburses at around $32,000. So I make a $12,000 profit on that knee.”

But it’s not pure profit because, unlike every other professional clinician, prosthetists aren’t paid on a fee-for-service basis. The clinical care they provide is bundled together with the cost of the device itself. So the $12,000 markup has to pay for every office visit the patient makes over the three to five years of that device’s useful life. Many hours of the prosthetist’s time and expertise—from initial assessment, fitting, and fabricating to routine maintenance, adjustment, and troubleshooting—are covered by that $12,000 payment. So are all the hours spent on insurance filings, appeals, and other administrative paperwork. Professional education, technology upgrades, staff salaries, rent, office supplies, and all the clinic’s other business expenses come out of the $12,000, too. It also has to cover denied and unreimbursed claims.

“To use the analogy of a prosthesis versus a car: When you’re buying a car, you need to look at not only the price of the car but also the cost of ownership,” says Joe McTernan, director of health policy and advocacy for the American Orthotic and Prosthetic Association. “That includes insurance, oil changes, brake replacements, filters, tires, all the things that go into maintaining it.”

If the family sedan’s ownership cost were bundled together with the retail price, the car might sell for, say, $80,000. Instead, you fork over $30,000 for the vehicle itself and pay the ownership costs as you go. If you sell the car after two years, you only pay two years’ worth of ownership costs—and you can claw back a chunk of the original purchase price on the resale market.

None of these dynamics exist in the prosthesis market. The device plus five years’ worth of clinical care are rolled into a prepaid, nonrecoverable payment that’s largely determined by Medicare.

Despite these imperfections, the market might make sense if every case were as simple as this one. But few cases are. To begin with, every insurer reimburses at a different rate for each L-Code. The same knee that brings a $32,000 reimbursement for a Medicare patient might only fetch $30,250 if Aetna is the payer, or $24,750 if the claim is filed with the Iowa Division of Workers Compensation. Moreover, says McTernan, manufacturers don’t charge every clinic the same price for components. “If you have a large company that’s purchasing hundreds or thousands of units a month, their acquisition cost is clearly going to be different from somebody that’s purchasing three units a month.” And then there’s the fact that some patients require far more hours of clinical care than others. “One patient needs five appointments [in five years], and another has complex needs and I’m seeing them 30 to 35 times,” Berry says. “The reimbursement for those two patients is identical.”

Things get even more tangled when we move beyond the C-Leg and consider other MPKs. Berry pegs the clinic’s cost for the Genium knee—Ottobock’s higher-performing alternative to the C-Leg—at around $30,000. “My time, expertise, equipment costs are all exactly the same as for a C-Leg,” Berry explains. “But Medicare says, ‘It’s a microprocessor knee, so it uses the same L-Code [5856] and gets reimbursed at the same rate.’” In other words, the $20,000 C-Leg has $12,000 worth of limb care priced into it, while the $30,000 Genium only provides for $2,000 worth, which doesn’t come anywhere close to covering the actual cost of delivering the necessary care.

Clinics would never sell components at such steep losses, and that serves neither the patients who need premium technology nor the manufacturers who need to move inventory. That’s where code L-5999—“Lower extremity prosthesis, not otherwise specified”—comes in. L-5999 covers products and services that don’t fit squarely within any other L-Code. Because it’s a catch-all category, Medicare doesn’t have a standardized reimbursement rate for L-5999, so providers can set their own prices and haggle with payers on a case-by-case basis. It’s a loophole that clinics can—and sometimes do—exploit to drive up their earnings. Most prosthetic clinics don’t abuse L-5999, but it happens often enough to create a ripple effect that affects the whole price structure.

“Why don’t we just add $12,000 to every device and call it a day?” Berry asks. “This system is broken, and patients get caught in the middle. You can’t make heads or tails of it.”

YOU MAY HAVE NOTICED THAT THE DISCUSSION so far has focused solely on the tail end of the supply chain—the $12,000 clinical-care markup that gets bundled into the retail price. What’s happening at the other end of the pipeline, where the $20,000 knee gets manufactured?

That’s a far more daunting accounting exercise. Without access to proprietary information, it’s impossible to factor out the precise component costs of microprocessor knee production. However, a well-qualified manufacturing industry veteran advises Amplitude that $2,000 to $2,500 per unit—including materials, labor, factory overhead, and product development—is a realistic estimate. A more conservative projection of $5,000 per unit would still leave device makers a very healthy gross margin of about 75 percent.

These figures are consistent with financial filings from Össur, which has reported an average gross profit (for all products and services, not just microprocessor knees) of 62 percent in this decade. That margin isn’t far off the average gross profit for all medical device manufacturers, which various sources place between 55 and 60 percent. Subtract operating costs (such as marketing, sales, distribution, and administrative overhead), taxes, and accounting deductions, and Össur’s net profit has averaged 8 percent annually in this decade—again, consistent with rates reported by other medical equipment makers. (Össur’s main direct competitors—Ottobock, Blatchford, and Proteor—are privately held and therefore not required to publish detailed financials.)

Looking beyond the medical device industry, the average gross profit in auto manufacturing is about 15 percent; construction supplies, 27 percent; consumer electronics, 32 percent; and heavy machinery, 35 percent. The cost of an industrial robot has fallen by half since 2012, from $47,000 to $23,000, and industry analysts expect it drop another 50 percent before this decade is out. Over the same period, the cost of an MPK prosthesis—whose component materials, engineering, and computing power aren’t far off from a robot’s—has hardly budged.

Berry counters that it’s unfair to compare high-volume industries such as consumer electronics or cars with niche industries such as prosthetics. “When people tell me that if more people got legs it would become more affordable, I tell them they aren’t considering all the nuances,” he says. “They don’t know the manufacturing process. I’ve been to the facilities where they’re making these devices, and the volume is just not there.”

It’s also fair to note that other advanced mobility devices (power wheelchairs, for example) have remained as stubbornly expensive as artificial limbs. The same goes for internal prosthetic devices, such as artificial hip and knee implants. Costs have been escalating for decades throughout the US healthcare industry. The prosthetic sector’s cost challenges are just part of a much broader problem.

But that doesn’t mean it’s impossible to create a more efficient prosthesis market—one that’s easier for consumers to navigate and more equitably balanced between sellers and buyers.

One potential reform, long debated within the O&P profession, is to unbundle clinical care from the sale of the device and compensate prosthetists on a per-office-visit basis. That would cut 30 to 40 percent off the initial purchase price, enabling more amputees to acquire high-performing limbs. And many clinicians think it would allow them to provide better care and get better outcomes for patients.

“Since the day I moved to this country, I’ve thought the billing system of paying for the product doesn’t serve the patient or the practitioner,” says Berry, who began his career in Canada’s single-payer healthcare system. “It’s archaic, and it doesn’t make any sense whatsoever. We’re not having this conversation in Canada, Germany, Sweden, England, or anyplace else. This conversation doesn’t exist in those countries.”

“There’s been a lot of discussion about that,” adds McTernan. “Younger prosthetists are saying, ‘The people I took graduate classes with, who are now rehab doctors or physical therapists or some other type of clinician, are all getting paid based on their time, intensity, and skill. So why am I getting paid to provide a device?’ I understand that, but one problem is that doctors are no longer being reimbursed strictly on time, intensity, and skill. They are starting to move toward a value-based care system, where they set their reimbursement based on patient outcomes.”

Value-based care is another reform that has many supporters within the industry. That’s the philosophy behind Medicare’s recent proposal to expand coverage for MPKs, a reform the major manufacturers pushed for. The data suggest that MPKs, though more expensive, ultimately save money by reducing falls, injuries, and other adverse outcomes. Initiatives such as the Limb Loss and Preservation Registry will make value-based pricing more achievable by collecting the data necessary to identify optimal limb-care solutions.

While changes in clinician compensation might help, new production and distribution models are the surest way to empower consumers. Startups such as Open Bionics, Levitate, Unlimited Tomorrow, and Hutchison’s ProsFit are circumventing the L-Code-mediated healthcare complex entirely and selling directly to amputees. They’re testing the theory that a market which prioritizes affordability, convenience, and customer choice can drive sales volumes upward, push prices downward, accelerate technological innovation, and maintain very high clinical care standards, while serving vastly more amputees than the present system.

The industry’s leaders aren’t sitting on the status quo. Össur, Ottobock, Hanger, and other major players are attempting to lower costs and reach more customers by introducing new technologies, improving clinical care, and lobbying for more generous coverage. They rightly note that the present system, however imperfect, has improved countless lives and produced miraculous outcomes that wouldn’t have even seemed possible a generation ago.

But the current market leaves too many amputees frustrated, confused, and angry. Most damning of all, it leaves millions of amputees around the globe completely priced out of the market. That’s Alan Hutchison’s fundamental critique, and the target of the cynics’ snark: How effective can a marketplace be if it fails to provide any solution at all for so many of its customers?

One commenter in Hutchison’s LinkedIn debate opined that it’s impossible to put a fair price on mobility, so why bother trying? “Mobility for anyone is invaluable,” Hutchison responded. “This, however, should not be exploited.”